Making Hard Money, Easy

Fast, flexible real estate lending across 42 states. Over $100M funded

Why Work With Us

Quick Closings

Close in as little as 14 days. We keep the process smooth, clear, and fast — no delays.

Flexible Loan Options

Whether it’s a flip, rental, or new build, we tailor the right loan for your strategy.

Transparent Support

Talk directly with real lending experts. We guide you from quote to funding without surprises.

How It Works

1. Submit Your Deal

Send basic details about your property and plan. No long forms required.

2. Receive Terms in 24 Hours

We’ll send you a custom quote tailored to your scenario — fast and clear.

3. Simple Underwriting

We don’t ask for unnecessary docs. You’ll work with a dedicated deal manager.

4. Close & Fund

Our closings are quick — average 14 days or less. Funds wired directly to title.

Recently Funded

$100M+

In Funded Loans

500+

Investor Clients Served

14 Days

Average Time to Close

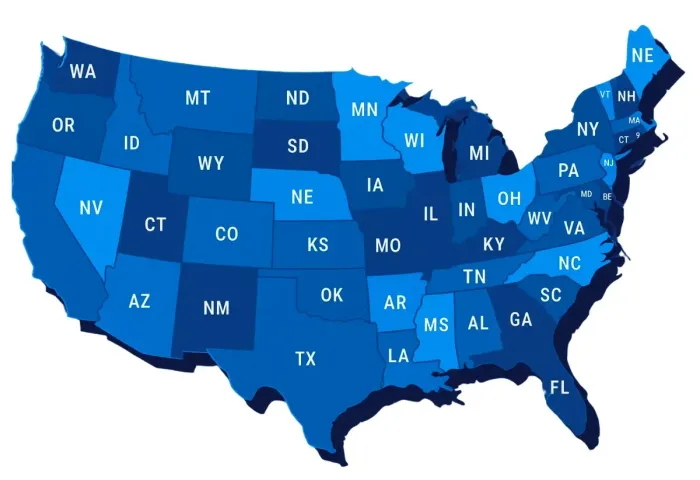

42 States

Covered Nationwide

Testimonials

Closed my flip in 12 days. Smooth and easy!”

Rachel

Florida

Funded my rental property fast. No income docs.

Brandon

Georgia

“I needed $300K for a duplex rehab. CapitalFlow got it done in time. Super fast and transparent.

Luis M.

Texas

Coast to Coast Capital

We support real estate investors in 42 states — from booming urban cores to developing suburban markets. Whether you're flipping in Tampa, building in Phoenix, or buying rentals in Charlotte, our team understands your market and brings tailored financing that matches your goals.

FAQs

What credit score is required?

We typically recommend a FICO of 660 or higher, but we evaluate each deal based on its own strength.

Can I get a loan through my LLC?

Yes. All of our loans are made to business entities, including LLCs.

How fast can you close?

We average 14 days or less from term sheet to funding, depending on appraisal/title.

Do I need tax returns or W-2s?

No. Our DSCR and fix & flip loans don’t require personal income verification.

Do you lend to first-time investors?

Absolutely. Whether you're starting out or scaling up, we can help.

Can you finance out-of-state properties?

Yes — we lend in 42 states. No matter where your deal is, we likely cover it.

Ready to Fund Your Next Deal?

Submit your loan scenario today and get custom terms in just 24 hours.